SpaceX IPO Prospects

Future valuation of SpaceX will dwarf terrestrial companies

Reportedly SpaceX are preparing to sell their shares to the public, ideally around June next year, in what promises be the biggest Initial Public Offering (IPO) ever. The company should be valued at $1.5tn, although this is expected to rise rapidly, making SpaceX the most valuable company in existence.

Projected Value

“With a LOT of work and good ideas, I think it [Tesla] could exceed the value of all transport companies, excluding SpaceX” ~ Elon Musk/X

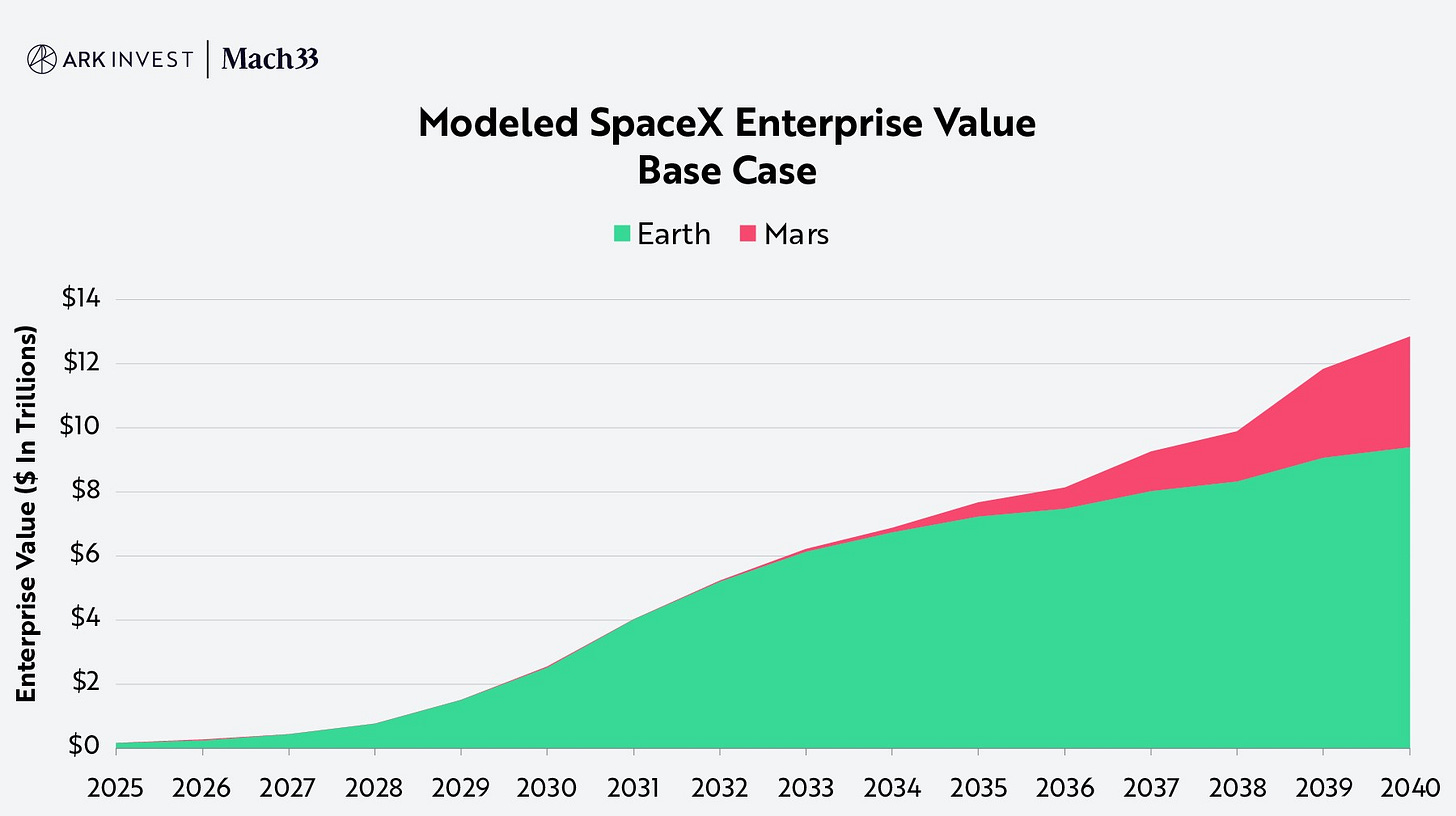

Currently Tesla is valued at ~$1.5tn, placing it on equal footing with SpaceX for the IPO. However Tesla’s value must exceed $8.5tn by 2035, to complete Elon Musk’s bonus plan. Overall this suggests SpaceX should reach $10tn in value by the middle of next decade, roughly gaining $1tn/year. Note: many financial analysts believed Musk couldn’t complete his 2018 bonus plan in 10 years, yet he hit all the performance milestones in only 3 years, hence he’s more than capable of completing the current plan, based on past performance.

SpaceX should hit the ground running following the IPO, because retail investors are clamoring for the stock. For reference, SpaceX is currently worth $800bn, yet its value is projected to rise to $1.5tn for their IPO in mid 2026. If the share price abruptly doubles, you might expect existing investors (Google, Fidelity Investments, Baron Capital etc) to cash in, precipitating a decline in the stock price post IPO. However, Google and Fidelity invested in SpaceX in January 2015, when the company was valued at $10bn, and doggedly held onto the stock despite the 80X increase...

“I don’t expect to sell in my lifetime Tesla or SpaceX [stock].” ~ Ron Barron, Chairman of Baron Capital

SpaceX Business

A SpaceX IPO could raise $200bn, more than enough to maintain the company’s forward momentum.

“A public offering could raise a significant amount of capital that enables us to ramp Starship to an insane flight rate, deploy AI data centers in space, build Moonbase Alpha and send uncrewed and crewed missions to Mars.” ~ Bret Johnsen, SpaceX CFO

Some believe building a data center in space is impractical, which Musk finds risible: -

“SpaceX has way more satellites in orbit than the rest of the world combined, so maybe we know a thing or two about the subject 🤣 Starlink V3 [satellites] will be 20kW and launched at scale around Q4 next year. No problem to scale that to >100kW if the satellite mass is shifted towards solar arrays and radiators for AI compute, instead of giant phased array antennas for Internet connectivity... It would use the same laser comms system as Starlink to connect to Starlink. An AI satellite is easier, not harder, than the Starlink V3 design, which is a marvel of engineering created by an epic team of humans.” ~ Elon Musk/X

Creating and operating a data center on Earth can be challenging and involve significant difficulties, mainly associated with project finance, local politics and regulations, planning permission, land purchase, build/lease cost, grid supply, battery backup and longterm power cost. However, space is free, along with solar power, which is continuous in sun-synchronous orbit so no backup batteries required. Starship should enter service in 2026 allowing SpaceX to scale fast, beating many other data centers to market. In the near future raw compute power should steadily increase in value; for example: Tesla’s Optimus robots have to be trained by AI to perform every conceivable task, likely putting compute power at a premium.

Starlink is a massive cash cow, with revenue doubling every year. Most major airlines will choose Starlink, along with shipping companies, western militaries and ordinary consumers who live outside conurbations. Currently Starlink is expanding coverage to include cell phones which promises to push revenue past $1tn p.a.

Many believe SpaceX’s drive to open new markets on the moon and Mars is a money pit which Musk strongly counters: -

“…[Mars] that’s really where a tremendous amount of entrepreneurship and talent would flourish, just as happened in California when the Union Pacific railroad was completed. And when they were building the Union Pacific, people said it was a super dumb idea because ‘there is hardly anybody living in California.’ But now today we have sort of at least, U.S. epicenter of tech development and entertainment and it’s the biggest state in the nation.” ~ Elon Musk

In essence the moon and Mars must develop their own internal economies to support all the planned activities e.g: propellant production, mining, construction, transport etc. SpaceX will be intimately involved in these activities and provide transport to and from these expanding new worlds. The railway barons of the nineteenth century (Vanderbilt, Harriman etc) realized the potential of opening new territories, opening whole new worlds will be like that except on steroids.

App of Apps

New applications for space have long been sought, beyond communications and GPS satellites. Orbital data centers promise to exceed their utility in the future due to insatiable demand for AI, coupled with low operating cost. Harnessing agentic AI will certainly help SpaceX overcome all the technical problems associated with opening new worlds. Elon Musk suggests the pace of technical development at SpaceX must increase exponentially to establish a colony on Mars in his lifetime, realistically agentic AI will go a long way to achieving this.

In Conclusion

A SpaceX IPO seems a golden opportunity for retail investors to benefit from SpaceX success. If the company achieves their ambitious goals it could create generational wealth for many, a great hedge against AI job displacement.

Overall there seems no limit to space or the potential for SpaceX expansion. Believe Christmas comes early if SpaceX IPO in late June or early July.