Since its inception in 2003, Tesla has made slow but steady inroads into the auto market, notably in the US, Europe and China. For whatever reason, the legacy producers seem unwilling or unable to emulate Tesla’s success with Electric Vehicles (EV), going by the quantity of Zero Emission Vehicle (ZEV) credits they purchase from Tesla to avoid fines for producing insufficient EVs.

“Tesla generated $739 million in credit sales in the third quarter [2024], or about $1,600 per vehicle sold, up about $300 per vehicle year over year.” ~ Barons

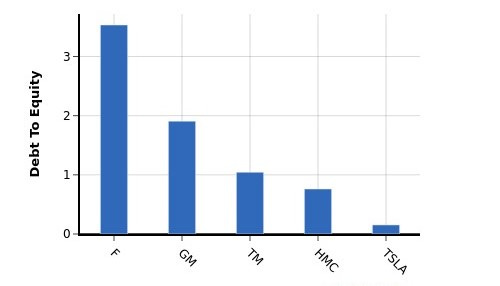

Tesla is committed to converting the world into a sustainable transport economy, which suggests they have an endgame in mind to engineer this transition. The legacy auto industry is huge and inflexible, a good analogue might be the Titanic which spotted the iceberg ahead but was unable to avoid it due to sheer momentum. Notably the ship didn’t die immediately, it limped on for hours taking on water, before finally going under. Like the Titanic, the legacy industry has been dealt a mortal blow but still limps on, sinking ever deeper into debt.

Unfortunately there is also massive debt at the consumer, business and government levels, similar to the situation in 2006-7, i.e. the run-up to the great recession. Certainly Elon Musk seems convinced some kind of recession is looming and no doubt factored it into his plan. When the recession hits, most of the legacy industry will go insolvent as auto sales collapse and private investment dries up. No doubt government will support many of these companies, allowing them to rationalize their manufacturing operations to a much smaller base. Hence a recession could be a boon for Tesla because they have huge cash reserves ($33.6bn in October 2024) and fully prepared for this eventuality.

Inner strength

Tesla is antifragile, i.e. adversity only makes them stronger. During COVID the supply chain collapsed but Tesla dug deep, produced more components inhouse or found suitable alternatives, effectively changing their vehicle design on the fly. This allowed them to maintain sales online, stealing a march on legacy auto whose dealerships were closed. The company is inherently agile, so it can quickly adapt to new circumstances, such as a recession. Likely some non-essential personnel would be lost but this will only make them more cost efficient. In addition, Tesla should roll-out low cost models in early 2025, allowing them to adapt to a more cost conscious market. As an extra inducement, EVs are less expensive to run, hence more attractive than Internal Combustion Engine (ICE) vehicles, when consumer income is constrained. For those who can’t afford a new car, Tesla will roll-out a Robotaxi service in 2026, which costs a fraction of normal taxis. Overall the recession will likely speed the transition to low cost Robotaxis, as people realize they don’t need to own a car to get about. Overall great news for Tesla, another nail in the coffin for legacy auto.

Preparing for the bounce

When the recession bottoms out Tesla can prepare for when markets pick-up. Work for the construction industry will have evaporated, so Tesla can build new plants at rock-bottom prices. They’ll have a mighty warchest at this point, perhaps $40-50bn, and won’t be afraid to use it. Then greater scale should lead to lower prices, adding fuel to the fire for EV sales. Note the majority of people who buy Teslas refuse to return to ICE vehicles, which suggests Tesla will steadily accumulate a massive customer base. Of course they have other irons in the fire like grid storage and Optimus robots, which should see massive expansion as the economy picks up. In times of recession, the government likes to stimulate the economy to speed recovery, what better way to transition to a more technologically advanced future than Tesla?

What to expect

In some regards SpaceX provides an excellent example of what to expect from Tesla and the auto industry. Currently SpaceX launch most of the payload sent to space at prices too low for the legacy launch industry to compete.

“SpaceX might exceed 90% of all Earth payload to orbit later this year. Once Starship is launching at high rate, probably >99%.” ~ Elon Musk/X

New technology, like rocket reusability, put SpaceX on another level, which legacy providers are unwilling or unable to reach. Their leading competitor, The United Launch Alliance (ULA), has been on the block since 2019 but nobody wants to buy it. In addition, Boeing wants to unload the majority of its space business because it’s too hot in the kitchen. As legacy players like Lockheed and Boeing seek the exit, this makes room for scrappy startups like Rocket Lab, Impulse Space and Relativity Space to grow. So while SpaceX currently enjoys a dominance that verges on supremacy, they have led the way for new space companies to find their wings and help break the stranglehold of legacy providers.

Tesla currently holds the top three spots for EV sales in the US, their propriety technology is simply too good for legacy to compete. Perhaps more importantly, Tesla has a completely different organization to most companies, that’s focused on technologic advance, which means legacy can never catch up. This implies Tesla will core out most of the old auto companies, leaving them little more than brands – trading off their prior good name. Again this should leave space for new EV startups around the world, although many existing EV companies will fold due to the recession. Overall Tesla should rise to unprecedented dominance, perhaps exceeding that of the Ford Motor Company in its heyday.

Virtuous Circle

“With a LOT of work and good ideas, I think it [Tesla] could exceed the value of all transport companies, excluding SpaceX” ~ Elon Musk

Tesla stock will fall in a recession, but many will see this as an opportunity to buy at bargain basement prices. When times are tough, many people who can’t afford a new car but believe in Tesla, will invest in the stock. Then as the stock recovers, they’ll buy a new Tesla, increasing sales figures and pushing the stock higher. Which will allow more people to buy a Tesla and so on, forming a virtuous circle. As Elon suggests the world is Tesla’s oyster, with no rival except SpaceX, who hold the commercial potential for many worlds and everything in between.

In conclusion

Expect big changes to the auto industry, recession means an end for some and for others a beginning. Tesla will plant when it rains then make hay when the sun shines. Counterintuitively recession should actually accelerate our transition to a sustainable economy.

Succinctly: Ragnarok for legacy auto, leads to promised land for Tesla.

What recession?

What about the Chinese companies?